FHA Loans - Detailed 2018

- A. Carter

- Feb 22, 2018

- 1 min read

Updated: Apr 10, 2018

FHA is a great option for first time home buyers!

FHA Loans are relatively easy to qualify for and are more forgiving of small problems with your credit history than conventional.

3.5% down payment (depending on credit score)

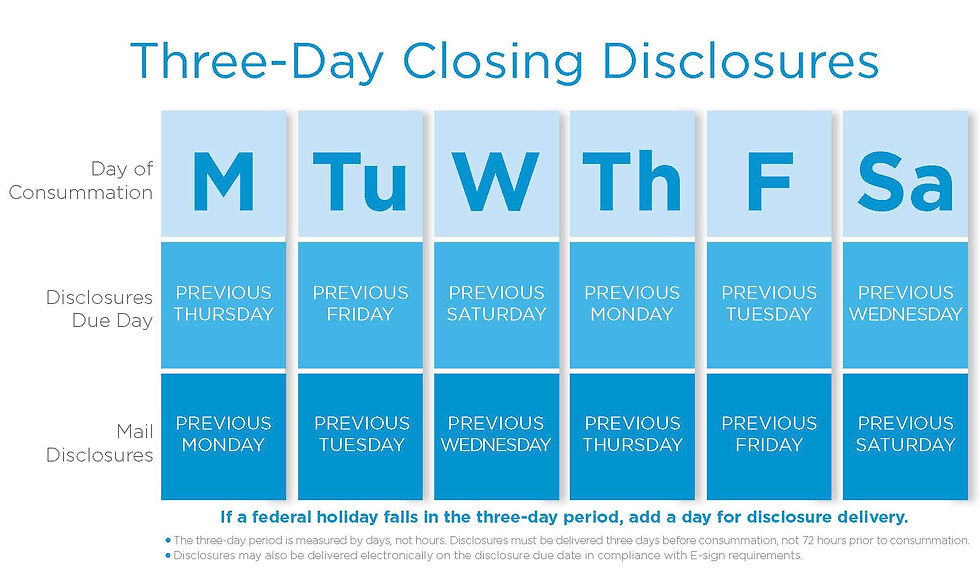

Terms of the loan may include closings costs

Flexible debt to income (DTI) ratio

Up to 6% seller contribution

Can be used to purchase or refinance

100% of the down payment and the closing costs can come from a gift

Credit

FHA typically requires two lines of credit but if you are lacking credit history you can try to qualify through a substitute form.

Other Great Benefits!

Borrowers can qualify 2 years after bankruptcy

Borrows can qualify 3 years after foreclosure or short sale

No PRE-PAYMENT PENALTY

FHA loans are assumable

Competitive Interest Rates

Lower Fees (such as - closing costs, mortgage insurance, etc)

Comments