What is TRID?

- A. Carter

- Mar 25, 2018

- 2 min read

Updated: Apr 10, 2018

To understand Tila/RESPA Integrated Disclosure Act we first have to break down two former Acts that were combined into the new TRID regulations.

The "T" in TRID stands for TILA or the Truth in Lending Act

The "R" in TRID stands for RESPA or the Real Estate Settlement Procedures Act

The Truth in Lending Act (TILA), was enacted in 1968, and the Real Estate Settlement Procedures Act (RESPA) was enacted in 1974. These two acts were to protect home buyers from hidden charges by real estate agents, lenders and title companies. By combining and modifying these acts with TRID, the federal government did away with the HUD-1 and replaced it with the Closing Disclosure (CD), and the Good Faith Estimate (GFE) was replaced with the Loan Estimate. These new forms condense the various fees and rates into two documents, along with the promissory note and security instrument.

Your lender will prepare and deliver the Closing Disclosure.

Loan Estimate

A 3-page document

Sets forth the loan terms, mortgage payments, costs at closing (cash to close, settlement charges, service fees) and other costs, many of which cannot change

Shows an estimated total monthly payment including principal, interest, taxes and insurance (PITI)

Must be delivered to the borrower within 3 days after applying for your loan, but no later than 7 days before closing.

Closing Disclosure

A 5-page form

The Closing Disclosure ( can be similar to the Loan Estimate) compares the terms of the Loan Estimate with the terms of the Closing Disclosure

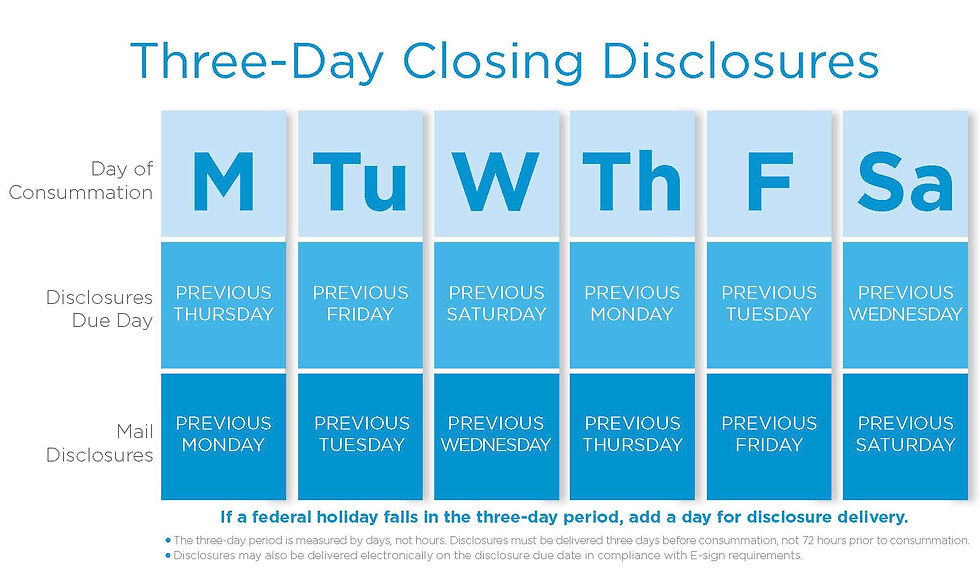

As a borrower, you cannot sign loan documents (at closing) until you have received and signed the Closing Disclosure at least 3 days prior

If there are any changes in your loan during this time period, a new Closing Disclosure may be required, which could extend the closing time period

This document replaces the HUD-1 and Truth in Lending Disclosure

The purpose is to help a borrower to understand all of the costs associated with a mortgage loan and who is covering those costs.

Promissory Note

The Promissory Note is the physical loan contract

Lists the details of the loan, the length of the loan, the interest rate, payment intervals, early payment penalties and other information

states that you are putting the home as collateral for the loan

Security Instrument

Depending on the state you sign either a mortgage or a deed of trust

Pledges the home as security for the loan

defines that the home will be occupied (primary residence), second home(secondary home, non-rental), or non-owner occupied(rental)

Application Elements

Consumer Name

Consumer Income

Consumer Social Security Number

Property Address

Estimated Value of the Property

Mortgage Loan Amount Sought

Fee Tolerance

The fee tolerances are 0% for required services that the borrower cannot shop for such as appraisal, credit report, tax services, etc

Fees in the zero tolerance category cannot increase from the Loan Estimate to the Closing Disclosure without being a tolerance violation.

The only exception would be if a fee increase is due to one of the events under the law for issuing a revised Loan Estimate.

Comments