VA Loans - Detailed 2018

- A. Carter

- Feb 22, 2018

- 2 min read

Updated: Apr 10, 2018

Verteran’s Affairs Home Loan is a great opportunity available to certain current and previous members of the military. No more difficult than applying for a standard home loan, VA loans often have much easier qualifications to meet than conventional loans!

Lets talk about some of the benefits of a VA Loan!

1. NO DOWN PAYMENT!

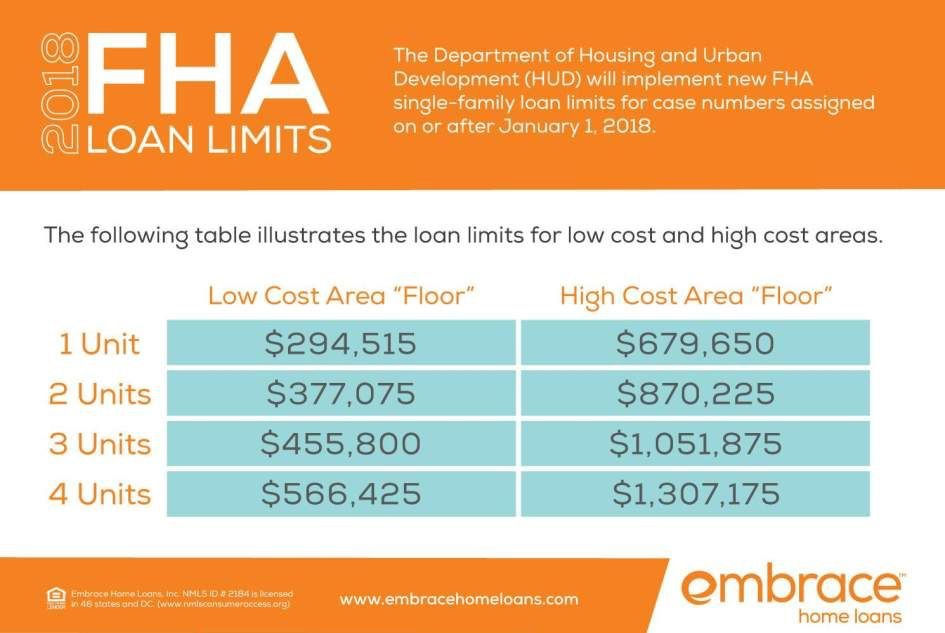

If qualified, homebuyers in most parts of the country can purchase a home up to $417,000 without a down payment while FHA is looking at 3.5% down and Conventional at 5%. This means 100% Financing!!

2. No Private Mortgage Insurance (PMI)

PMI is required on conventional loans if buyers cannot put down at least 20%, but with VA this is a non-issue!

3. Higher Allowable Debt-to-Income (DTI) Ratio

DTI on a VA loan averages about 41% or less; much higher than the DTI on FHA or Conventional.

4. No Prepayment Penalty

While other loans penalize borrows for paying off their mortgage, paying off a VA loan early is not a problem!

5. Flexible Bankruptcy and Foreclosure Rules

Qualifying for a VA home loan after a bankrupty of foreclosure is possible as long as two years have passed - the wait on other forms of loans can be much longer!

6. Competative Interest Rates

7. Sellers Pay Closing Costs

What can you buy with a VA Loan?

Single Family

Townhomes

Duplex

Condo

Financing for New Construciton

How to Qualify for a VA Loan

To qualify for a VA Loan one must be able to prove that you are gainfully employed with a steady income! You should also have not defaulted on a loan in the previous 12 months. If you have run into credit problems, borrows may be restricted for using this loan only to purchase a primary residence within the United States.

The minimum credit score for a VA loan is 620.

Sources: Veterans United

Comments