Understanding the Most Common Types of Mortgages

- A. Carter

- Feb 9, 2018

- 1 min read

Updated: Apr 10, 2018

This post is going to break down the types of loans available to purchase a home in a very basic way. We will look at the categories they fall under and their general ideas.

Mortgages start by being broken into three categories:

1.Government Backed Loans

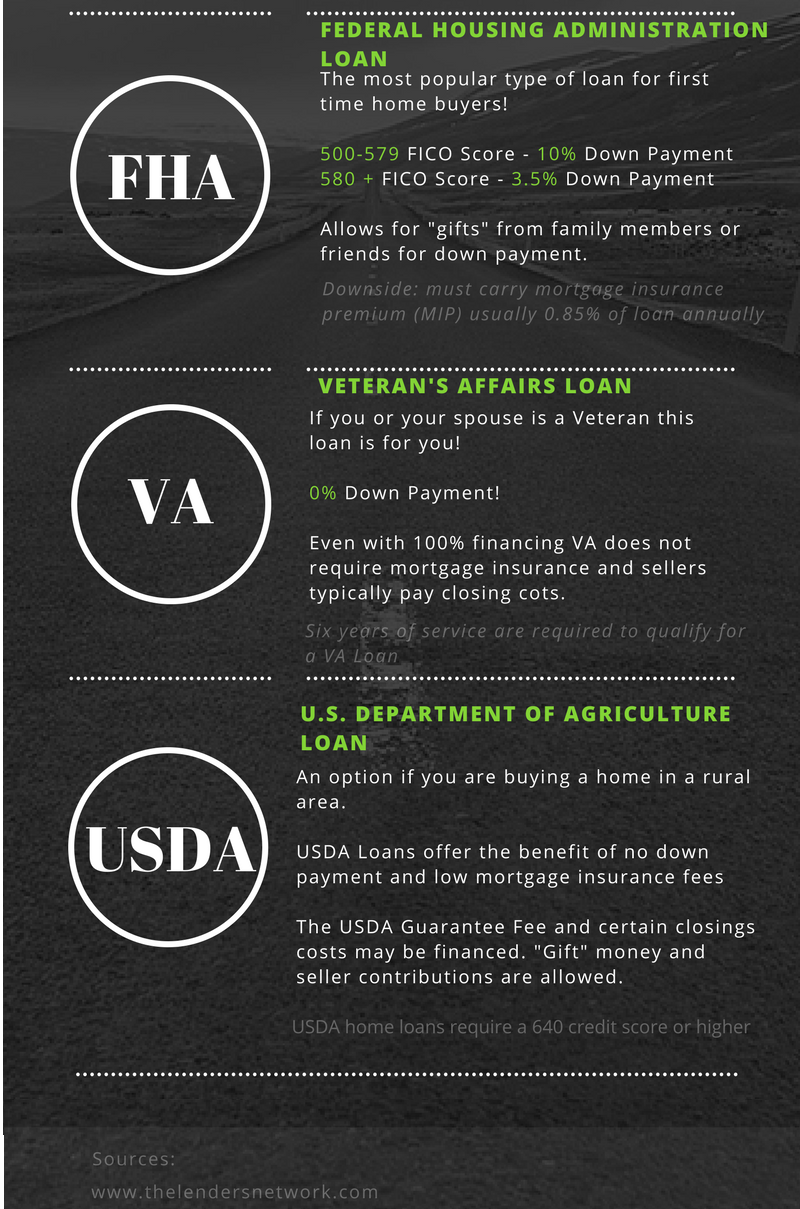

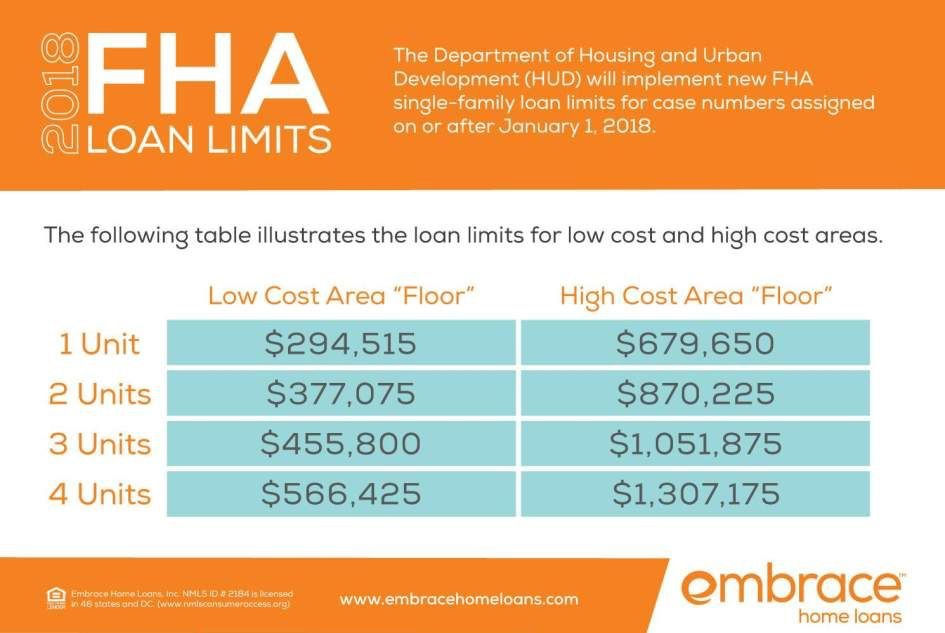

The government does not directly offer loans but they insure the loan. This means should the borrower become unable to make payments the government will pick up the tab. The Federal Housing Administrative makes it easier to get approved for a home loan by making the loan less risky for lenders, allowing the lender to lower their loan requirements.

Government Loans include: FHA, VA, USDA and FHA 203K.

2. Conforming Home Loans

Also known as a Conventional Loan. They are known as "Conforming" due to meeting the standards of Fannie Mae and Freddie Mac. Conventional Loans are offered by private lenders (Banks, etc) and are not insured by the Federal Government. The conforming loan amount for 2018 in the Orange County area of Florida is $453,100.00.

3. Non-Conforming Home Loans

A non-conforming loan exceeds to conforming limits of Fannie Mae and Freddie Mac. This is known as a Jumbo Loan.

Comments